Offshore Account for Beginners

Table of ContentsThe Single Strategy To Use For Offshore AccountThe Ultimate Guide To Offshore AccountOffshore Account for BeginnersAll About Offshore Account

2 usual false impressions regarding overseas financial are that it is unlawful as well as that it is only for the super-wealthy. As an expat you can use offshore banking lawfully as well as to your benefit.An overseas financial institution account is commonly used by those who have little belief in their local banking market or economy, those that reside in a much less politically secure country, those that can properly prevent tax in their brand-new nation by not paying funds to it, and also expats who desire one centralised financial institution account resource for their global monetary requirements.

Preserving a savings account in a nation of residence makes considerable as well as lasting sense for several expatriates. Unless you're attempting to alter your country of residence and sever all ties with your residence nation permanently, keeping a banking visibility there will certainly mean that if ever you intend to repatriate, the course will be smoother for you.

For instance, your company might require you have such an account into which your income can be paid monthly. You might also need such an account to have energies linked to your brand-new residential or commercial property, to obtain a mobile phone, rent out a house, elevate a home loan or buy a car.

The Best Guide To Offshore Account

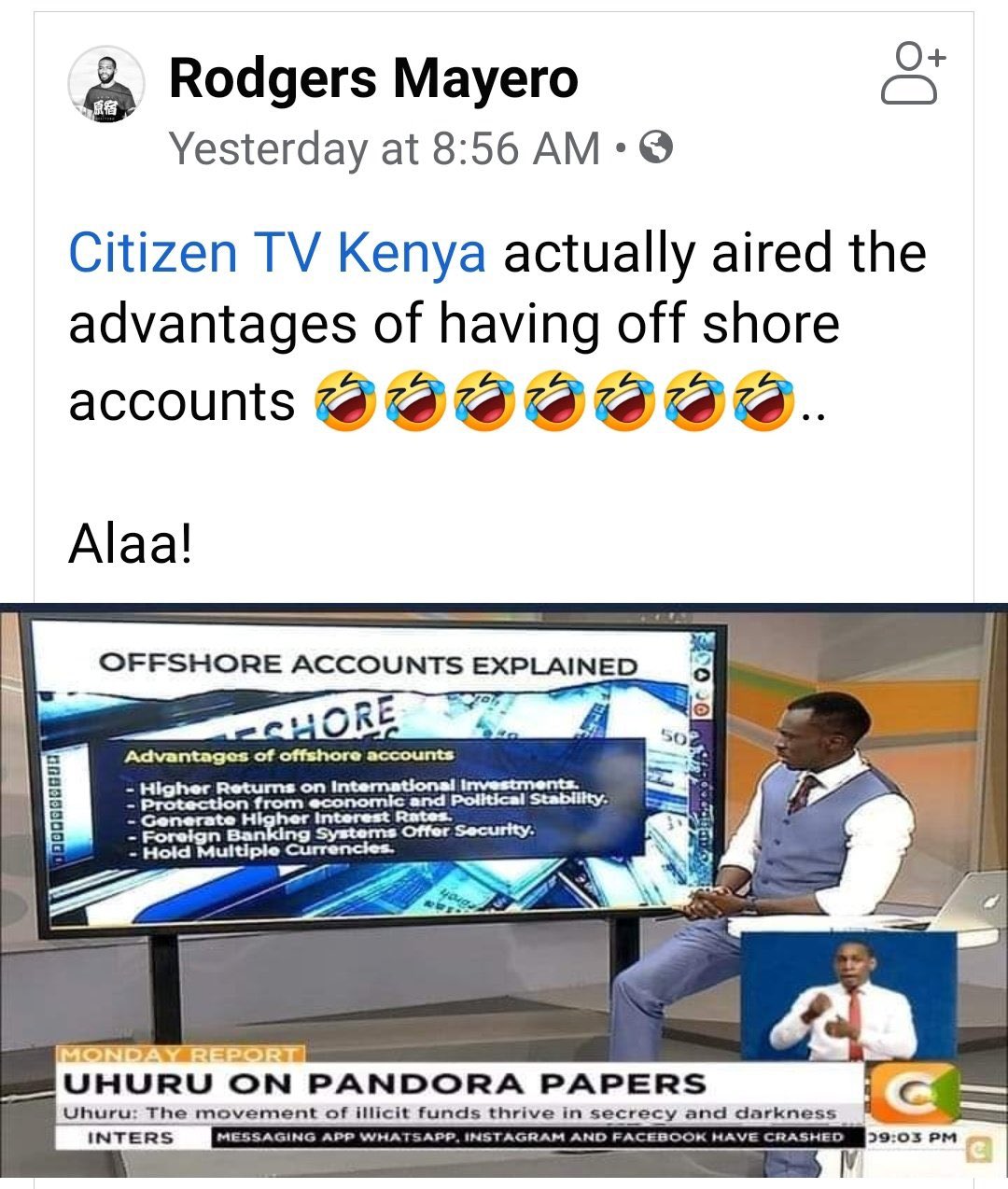

The main thing to remember is that offshore financial isn't necessarily an ideal solution for every single expat. It is very important to understand what advantages and disadvantages overseas financial has as well as just how it fits in your individual situation. To assist you choose whether an offshore checking account is right for you, here are the most noticeable advantages and disadvantages of overseas banking.

If the nation in which you live has a less than beneficial economic climate, by maintaining your wide range in an offshore savings account you can avoid the risks in your brand-new official website country such as high inflation, money decrease and even a coup or war. For those expats living in a country where you just pay tax obligation on the money you pay right into that nation, there is an apparent tax benefit to maintaining your money in an overseas bank account.

Expats can benefit from this despite where they remain in the world as it can mean they can access their funds from ATMs or online or over the phone any time of the day or night, regardless of what the time zone. Any type of interest made is normally paid without the deduction of taxes.

The Best Guide To Offshore Account

Note: professional estate planning guidance requires to be sought by anyone looking for to take advantage of such an advantage. Some overseas financial institutions charge less and also some pay more passion than onshore financial institutions. This is coming to be less as well as less the case nowadays, yet it deserves looking very closely at what's readily available when looking for to establish a brand-new overseas checking account. offshore account.

Less government intervention in offshore economic centres can mean that overseas financial institutions have the ability to offer more interesting investment services as well as remedies to their clients. You may take advantage of having a connection supervisor or private Recommended Reading financial institution account manager if you choose a premier or private offshore checking account. Such a service is of advantage to those who want a more hands-on strategy to their account's management from their financial institution.

and also allow you to wait for a specific rate before making the transfer. Historically financial offshore is probably riskier than financial onshore. This is demonstrated when analyzing the after effects from the Kaupthing Singer as well as Friedlander collapse on the Isle of Male. Those onshore in the UK that were influenced in your area by the nationalisation of the bank's parent company in Iceland got complete payment.

The term 'offshore' has ended up being identified with unlawful as well as unethical money laundering as well as tax evasion activity. Certainly any individual with an offshore bank account can be tarred, by some, with the same brush also though their offshore financial activity is wholly legitimate. You need to select your offshore territory carefully.

Little Known Questions About Offshore Account.

It's essential to look at the terms as well as conditions of an offshore bank account. It can be much more tough to fix any problems that might occur with your account if you hold it offshore.

And as well as abiding with these durable requirements, expats may still be able toenjoy more privacy from an offshore bank than they can from an onshore one. This factor alone is adequate for numerous people to open an offshore financial institution account. There can be expat tax read the full info here obligation benefits to making use of an offshore bank -however whether these use in your case will depend on your individual scenarios, such as country of residence.